How to Read Your Payslip

Welcome to the guide on understanding your payslip! Let's break down each section for better clarity based on the attached payslip format.

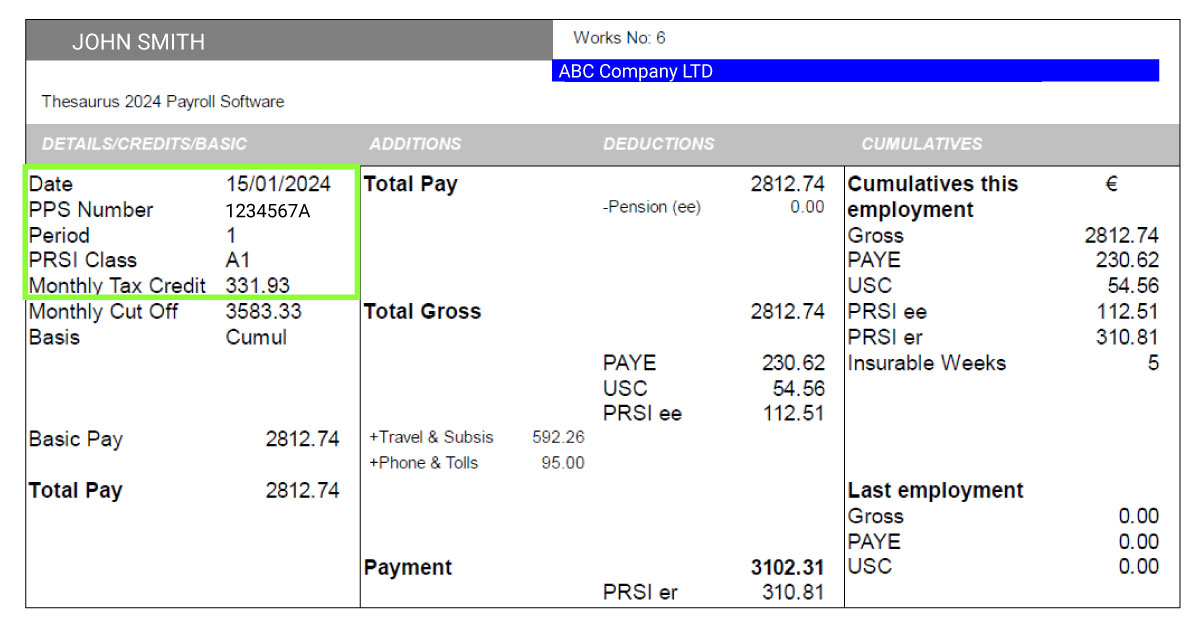

1. Personal and Employment Information

- Date: The date the payslip is issued.

- PPS Number: Your Personal Public Service number, unique to each employee in Ireland.

- Period: The pay period for this payslip, e.g., weekly, bi-weekly, or monthly.

- PRSI Class: The class under which you are insured, affecting your PRSI contributions.

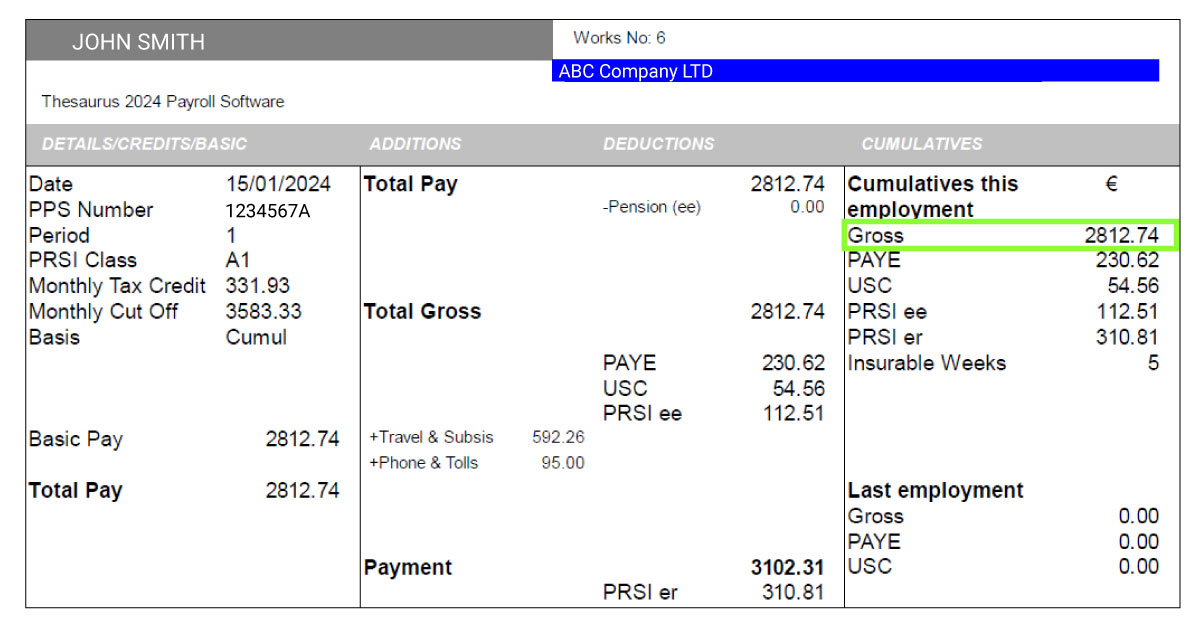

2. Gross Pay

This is your total earnings before any deductions. It includes:

- Basic Pay: The regular salary as per your employment contract.

- Additional Pay: Any extra payments such as travel allowances, phone reimbursements, or other benefits.

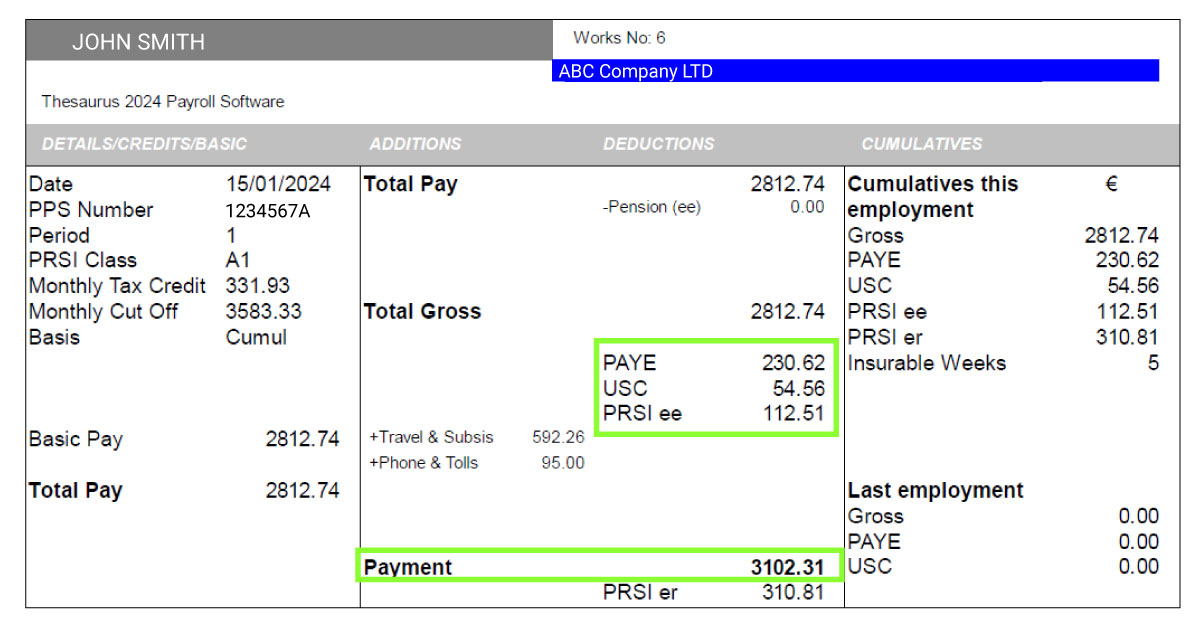

3. Deductions & Net Pay

These are the amounts taken from your gross pay for various mandatory and optional reasons.

- PAYE (Pay As You Earn): The income tax deducted from your salary by the employer and paid to the Revenue.

- USC (Universal Social Charge): A tax applied on gross income above a certain limit.

- PRSI (Pay-Related Social Insurance): Contributions for social insurance benefits.

Net Pay: This is your 'take home' pay after all deductions are applied. It is the actual amount you receive in your bank account.

4. Tax Credits and Cut-Off Points

Tax credits reduce the amount of tax you need to pay. Each month, your tax credits are divided and applied to your income, reducing the tax deducted from your salary.

- Monthly Tax Credits: The total tax credit for the year is divided by 12 and applied monthly. This reduces your PAYE liability.

- Cut-Off Point: This is the amount of income you can earn at the standard tax rate. Income above this limit is taxed at the higher rate. The cut-off point is also divided monthly.

5. Pension Contributions

Your payslip may include pension contributions from both you (employee) and your employer. These contributions help build your retirement fund.

- Employee (EE) Contribution: This is the portion of your earnings that you contribute to your pension scheme.

- Employer (ER) Contribution: Your employer may also contribute a portion to your pension on top of your salary.

Conclusion

Understanding each section of your payslip allows you to verify your earnings and deductions. It is important to regularly check your payslip to ensure everything is correct and raise any discrepancies with your HR department or the relevant authorities.